Federal Withholding Tables 2021

Besides Further Information About The 2021 Federal Withholding Methods And Some Faqs Are Also Prepared. By the amount of money being held back the workers have the ability to declare income tax return credit scores.

Employer Tax Withholding Tables

Review listed below to read more regarding it as well as to get Federal Tax Withholding Table 2021 WeeklyWhat is the Federal Tax Withholding Table 2021.

Federal withholding tables 2021. Federal Income Tax Withholding Tables 2021. Federal government in which companies subtract taxes from their workers payroll. It provides a number of changes like the tax bracket changes and the tax price each year along with the choice to use a computational link.

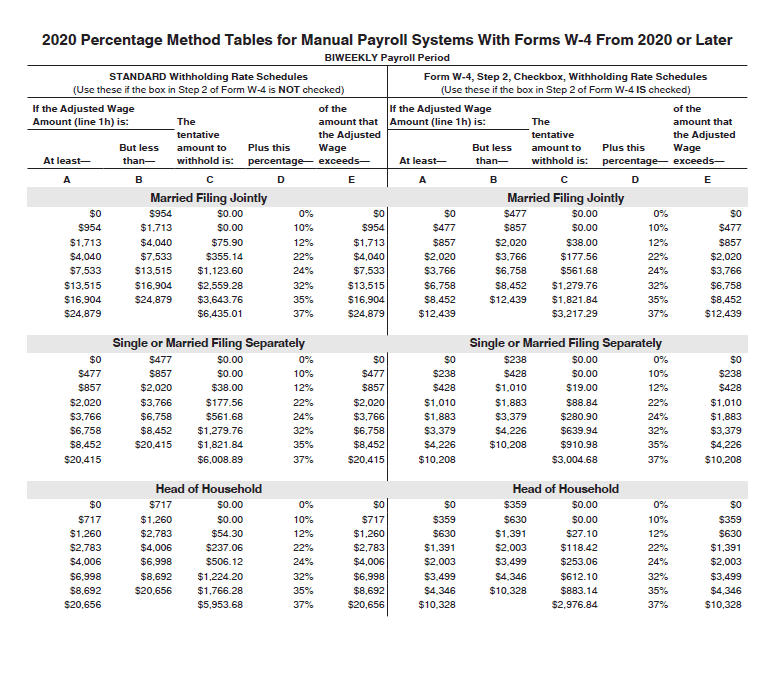

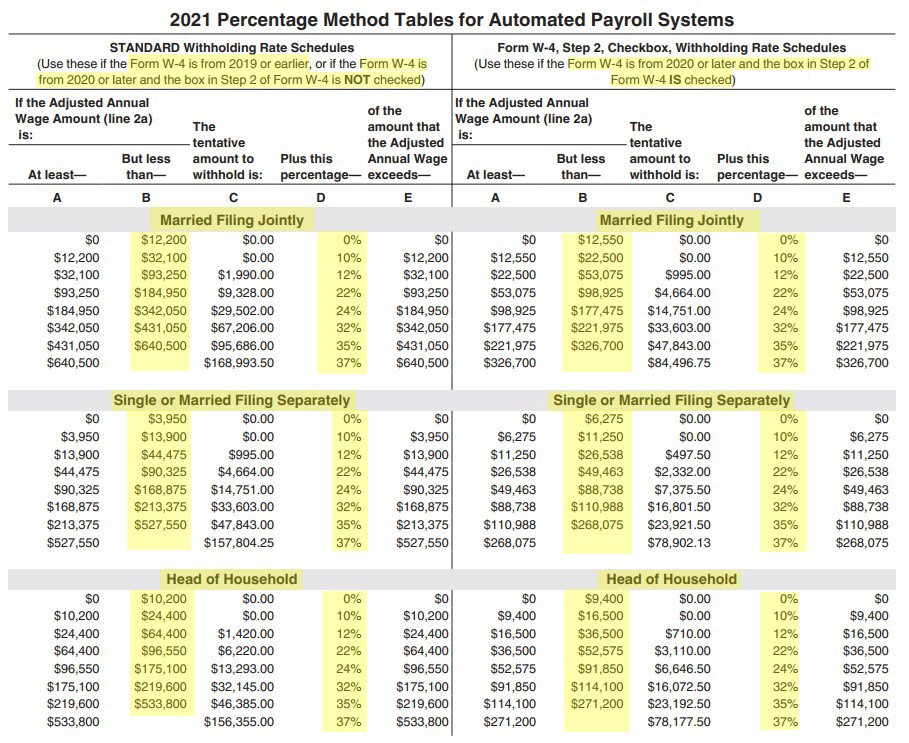

The employer determines the wages to be used in the withholding tables by adding to the 300 amount of wages paid the amount of 15870 from Table 1 under Step 1 45870 total. What Is Federal Income Tax Withholding Tables. Use the 2021 tables to figure out how much tax you need to withhold from an employees income.

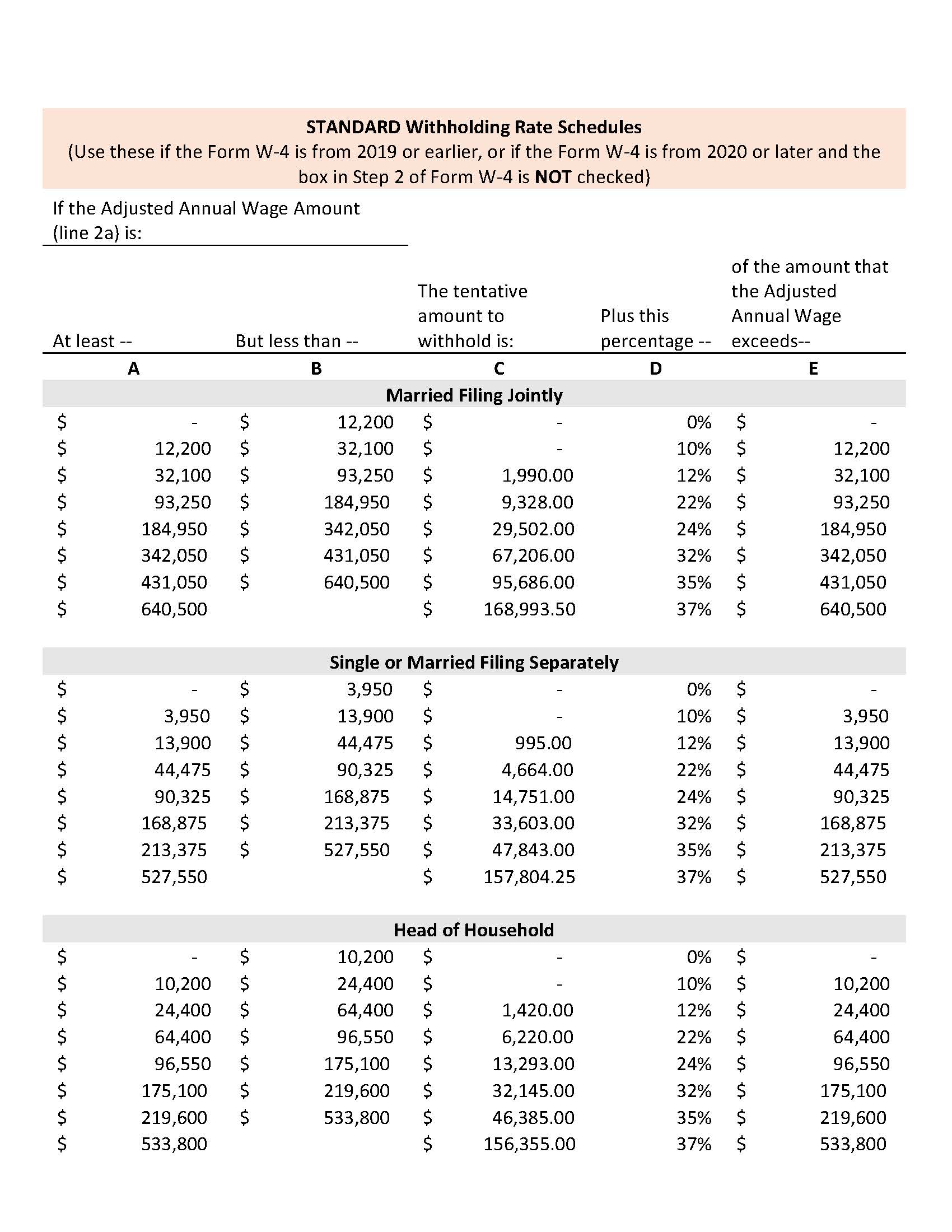

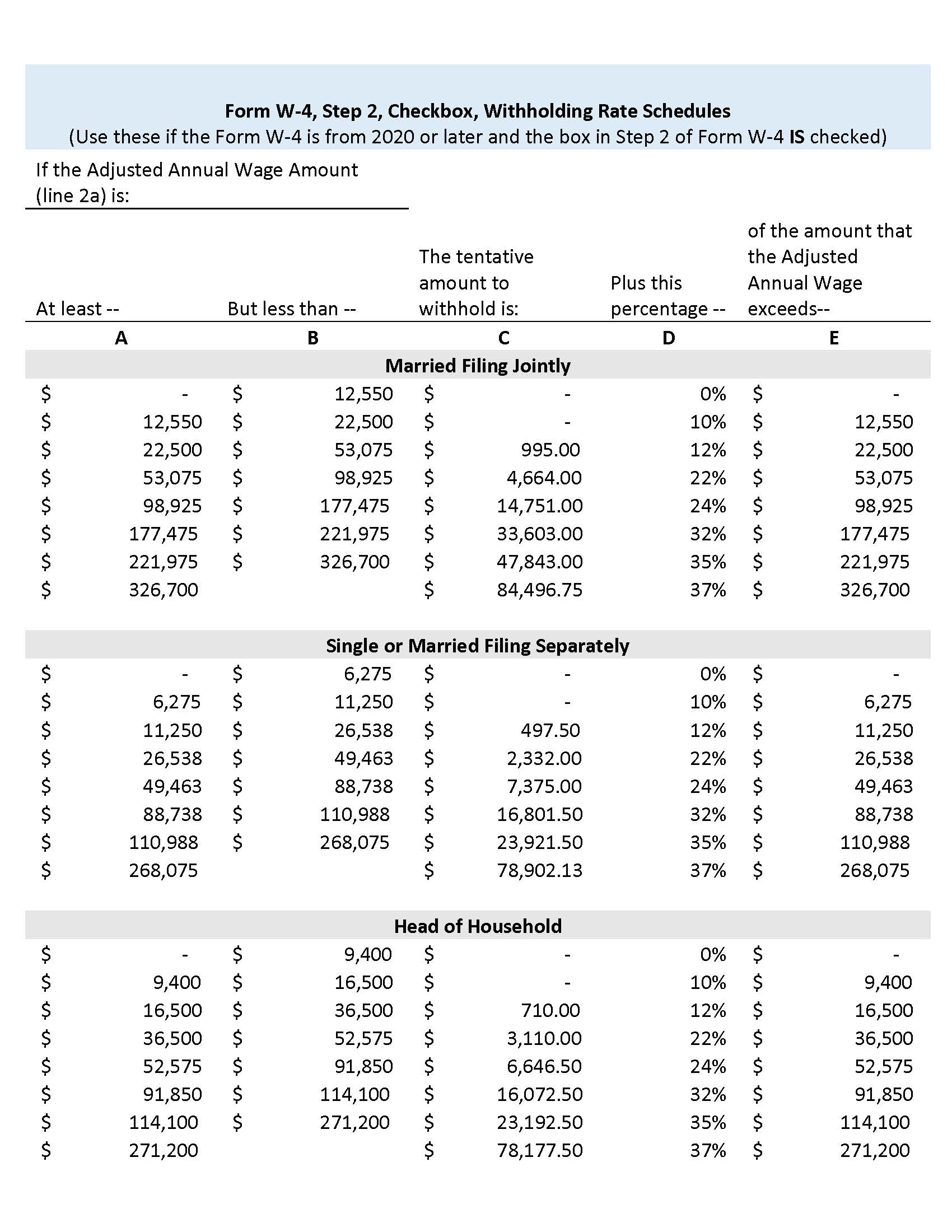

Federal Income Tax Withholding Tables 2021 The approaches of Federal Income Tax Withholding are stated under Publication 15-T. How to use a withholding tax table. 2021 Federal Withholding Tables For Employers - Federal Withholding Tables 2021 is the process needed by the US.

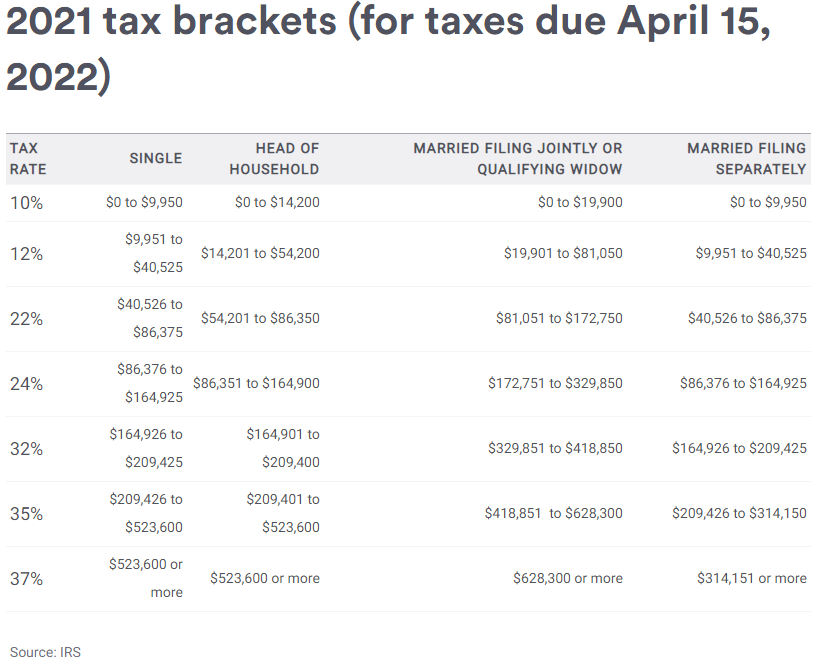

Review listed below to find out more concerning it as well as to obtain. The federal withholding tax rate an employee owes depends on their income level and filing status. The federal withholding tax has seven rates for 2021.

2021 Withholding Tax Table. Federal government in which companies deduct taxes from their employees payroll. The IRS has just recently issued the newly publicized Federal Income Tax Withholding Methods for use in 2021.

Take your employees Forms W-4 and determine how much federal income tax needs to be withheld for the 2021 tax year. This all depends on whether youre filing as single married jointly or married separately or head of household. Read below to find out more regarding it in addition to to get.

This file describes the procedure of calculating withholding by utilizing the portion method or wage bracket strategy consisting of tables that have actually been updated from the prior variation. This publication called Publication 15-T is used to announce the difference in tax rate and to. Did Federal Withholding Change 2021.

2021 Biweekly Federal Tax Withholding Chart. This paper defines the procedure of determining withholding by using the percent strategy or wage bracket strategy including tables that have been upgraded from the previous version. Federal Income Tax Withholding Tables For Employers 2021.

Find Out How Federal Withholding Tables 2021 Different From The Earlier Years. The employer has a manual payroll system and prefers to use the Wage Bracket Method tables to figure withholding. Employer Federal Withholding Tables 2020.

The techniques of Federal Income Tax Withholding are specified under Magazine 15-T. Federal Withholding Tables 2021 Just like any other previous year the recently altered Federal Withholding Tables 2021 was released by IRS to make for this years tax time of year. Federal Withholding Table For 2021 Federal Withholding Tables 2021 is the procedure called for by the United States federal government in which companies subtract taxes from their workers pay-roll.

Fill out Worksheet 1-5 to project your total federal withholding for 2021 and compare that with your projected tax liability from Worksheet 1-3. To utilize the desk and determine the federal income tax withholding the employers have to use the data from the W4 form employees submitting statuses and the pay. 15-T Federal Income Tax Withholding Methods along.

By the amount of money being withheld the staff members have the ability to claim income tax return credit history. If you use the worksheets and tables in this publication follow these steps. You may use the tables to determine the amount of your federal income tax.

Federal Tax Withholding Table 2021 Weekly - Federal Withholding Tables 2021 is the process required by the United States federal government in which companies subtract taxes from their staff members pay-roll. By the quantity of cash being held back the employees are able to declare tax returns debt. Now use the 2021 income tax withholding tables to find which bracket 2020 falls under for a single worker who is paid biweekly.

Federal Payroll Tax Table 2021. Fed Withholding Ranges 2021 As with any other previous year the freshly altered Fed Withholding Ranges 2021 was launched by IRS to make for this particular years tax period. Federal Income Tax Withholding Tables 2021 The methods of Federal Income Tax Withholding are mentioned under Publication 15-T.

IRS Publication 15-T 2021 Tax Withholding Tables 2021 Download. Fill out Worksheet 1-3 to project your total federal income tax liability for 2021. You will certainly locate five worksheets of withholding together with their particular tables so you can approximate tax withholding.

You find that this amount of 2020 falls in the At least 2000 but less than 2025 range. This information is now included in Pub. The discussion on the alterna-tive methods for figuring federal income tax withholding and the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members are no longer included in Pub15-A.

Federal Tax Withholding 2021 Federal Withholding Tables 2021 is the procedure called for by the US. The employer will use Worksheet 3 and the withholding tables in section 3 to determine the income tax withholding. It includes a number of changes including the tax bracket changes and the tax price each year combined with the choice to use a computational link.

IRS 2021 Tax Table PDF. Federal Tax Withholding Tables 2021 are the set up of information that helps employers to discover the sum of tax that should be withheld off their employees salary. By the amount of cash being kept the workers are able to claim tax returns credit score.

10 12 22 24 32 35 and 37. Employer Federal Income Tax Withholding Tables 2021 is out now. This record defines the procedure of calculating withholding by using the portion method or wage bracket strategy including tables that have been updated from the prior variation.

2021 Federal Withholding Tables Printable. Using the chart you find that the Standard withholding for a single employee is 176. 2020 Federal Withholding Allowance Table.

Check out listed below to learn more regarding it in addition to to get 2021 Federal Withholding Tables For EmployersWhat is the 2021 Federal Withholding Tables.

Calculating Gross Pay Worksheet Worksheets Are A Crucial Part Of Researching English Infants In 2021 Financial Literacy Worksheets Worksheet Template Consumer Math

Federal Withholding Table 2021 Payroll Calendar

2020 2021 Federal Income Tax Brackets

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

P15 Withholding Tables 2021 Federal Witholding Tables 2021

Pin By The Project Artist Game Plan On Understanding Entrepreneurship In 2021 Fixed Asset Accounts Receivable Accounts Payable

Irs 2018 Tax Tables And Tax Brackets 2018 Federal Income Tax 2018 Tax Table Tax Brackets Federal Income Tax

Federal Tax Withholding Tables 2021

Pin On Quickbooks Business And Taxes

Irs 2018 Tax Tables And Tax Brackets 2018 Federal Income Tax 2018 Tax Table Tax Brackets Federal Income Tax

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensati Internal Revenue Service Tax Refund Revenue

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Payroll Schedule Template Schedule Template Payroll Payroll Taxes

5 Best Consumer Staples Stocks To Buy In 2021 Cryptocurrency Investing In Stocks Buy Cryptocurrency

Powerchurch Software Church Management Software For Today S Growing Churches

Posting Komentar untuk "Federal Withholding Tables 2021"